Daddy inputs:

When I was a young child, I desperately wanted to buy a popular comic book. All my friends have it and when I told my parents I really wanted this comic book, they told me that I could ask for it for my birthday or ask Santa. My birthday was 4 months away and Christmas was even further away! I told my parents that this would not work for me and that I wanted my book much sooner. They explained that I could earn the money to purchase my book on my own. They offered to allow me to do chores in exchange for money but after doing the dishes, taking out the trash and mopping the floor, I realized that earning money was hard work and I was not making it fast enough!

So I put my entrepreneur thinking cap on and decided to offer to help my classmates to finish their homework for them for a fee 50 cents per assignment. Before I could manage to start doing their homework, my parents found out about this when they saw me putting my friends’ homework on my table and told me to return back to them immediately. I was not allowed to do others homework for a fee.

Luckily it was close to school holidays. My uncle who ran a provision shop then offered me to help to do some simple task like packing and weighing stuff in his shop every morning in exchange for $1 pocket money. After working for two weeks, I managed to save enough to buy my favorite comic book. As a bonus, I learned how to talk to potential customers and this communication skills greatly benefited me when I grew up.

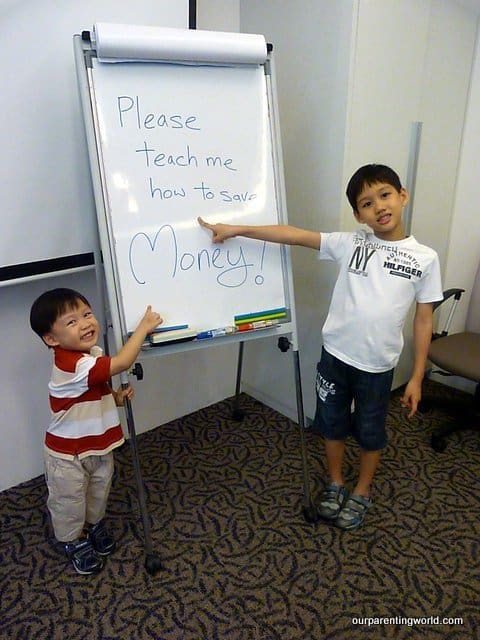

As a parent now, it is important to teach my children this same lesson and the benefits of saving money. It is never too early to instill these values as lessons will become the foundations of their relationship with money.

Here are some tips on teaching your kids how to save money:

- Practice what you Preach – It is important to teach by example. You are your child’s first role model and children often imitate their parents. Show them how you save money. This can easily be done with a jar where you can put your change in every day. Seeing you physically put away money makes it easier for children to understand this concept. When the jar is full, show them how you count what you put away and take them to your bank so they can watch you deposit your funds into your bank account.

- Learning Patience – Children live in a world today where instant gratification is the norm. Teaching your child that it’s okay to put away money to save for a large expense is easy and rewarding. If there is an expensive Transformers toy that they are looking to own, make them their own special jar such as “Transformers Toy Jar”. Label it and allow them to put money away every day or week. They can physically watch their savings grow and each week they will be more motivated to reach their goal. You can also match their contributions. This is a great way to encourage as well as motivate your child to keep saving.

- Play Monopoly! – Monopoly is a great game! It teaches children the importance of learning how to manage a fixed amount of money. It includes real life scenarios such as sometimes you’re going to need to pay for rent, how to make change, how to buy properties and help them to realize how sometimes financial deals may help in the short term but may not pay out in the longer term. This is a great learning tool and a fun way to spend a family night in. Remember to buy the Singapore version of Monopoly as the kids will be able to identify the local landmarks like Orchard Road etc.

- Be Charitable – Imagine if charity was a lesson instilled in all children, how much better the world would be? It is fun to receive things but it is even better to give. Teaching your child how to be charitable and help others is a good way for them to learn to be thankful for the things we have and that having material things in life is not important. Let your child put aside an agreed portion of the money they have earned and let them choose which charity they would like to donate their money to. Yesterday when a group of university students came knocking on our doors to ask for donation to support a charitable organization. Not only I donated a small sum of money, but I also made Gor Gor and Di Di took a small portion of their savings to donate as well. Now they understand the need to help people.

- You need to work to earn Money – This is a basic concept that all people should know but unfortunately do not. Instead of just offering a weekly allowance, allow your children to earn it. Set up chores that have a monetary payout when each task is completed. The harder the tasks, the more payout they receive. At the end of the week, they can receive their “paycheck” (i.e. pocket money) for the amount of work that they have completed that week.

Starting early to teach your children about money can help instill good habits that they will be able to carry through into adulthood. It is one of life’s important lessons and it is up to us parents to teach them how to be responsible, charitable and savvy with a dollar. Teaching your kids about money can be intimidating at first. Just remember to be open, honest and make it fun to learn about money!