Go Cashless with Canvas!

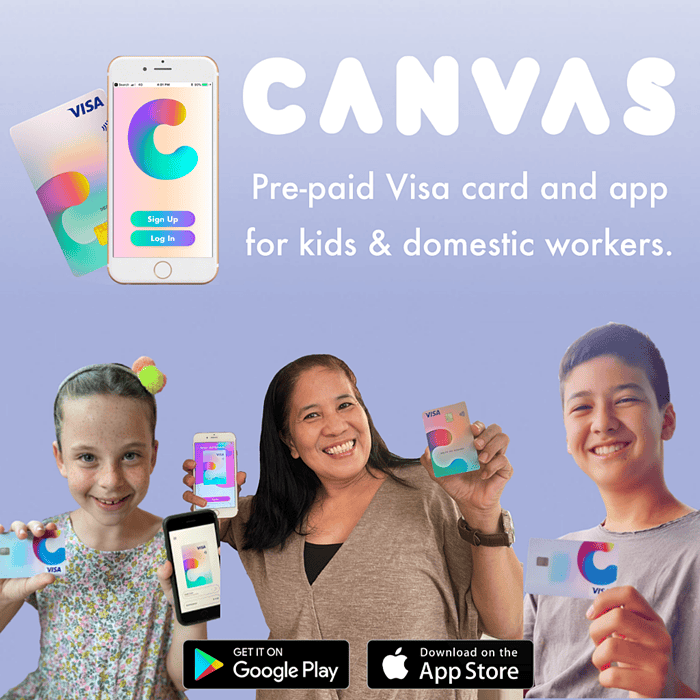

Canvas is a Singapore-based cashless digital solution launched in February 2021 for family finance administered by GoBankMe Technologies. Canvas has launched the Canvas Card and App that is designed for families and their household dependents in Singapore. This cashless pocket money and family finance app comes with an accompanying prepaid Visa Card. The App helps to bring more visibility to household spending and provide an alternative to spend independently, responsibly, and securely.

Image Credit : Canvas

Image Credit : Canvas

Canvas is like digital pocket money, parents will have full transparency and access over their children’s expenses. At the same time, the app provides children the autonomy, accountability and responsibility in managing their expenses. It is good to educate children the importance of managing their money and becoming familiar with financial technologies from a young age.

Canvas can also be used by employers of domestic workers to manage household purchases. Employers can transfer a prepaid budget into the Canvas Visa Card for family expenditures such as groceries and supplies and tasked the domestic workers to purchase for the family.

Customers can register, add cardholders, order cards, transfer funds onto the Canvas Visa Card, and manage spend through their mobile devices. With full parental and employer controls, children can make age-appropriate online transactions and domestic workers can gain independence and choice over everyday household expenditure. By taking the hassle out of cash-heavy pocket money and household expenditure, parents and employers no longer need to make trips to the ATM and can find more opportunities to understand digital spending as a family.

Georgina Bullworthy (middle) with her two kids.

Georgina Bullworthy (middle) with her two kids.

Image Credit : Canvas

Our team speaks to Georgina Bullworthy, Managing Director of Canvas to find out more. Georgina is a British Expat mum of two kids, Bertie (13) and Esme (9). She has lived in Singapore for 8 years. She has her own sales and marketing consultancy called Tell Me More where she helps SMEs to spread the word about their businesses. Canvas was introduced to her by a friend and she loved the concept. She joined them as the Managing Director to develop and launch the product in Singapore.

2. Where did the idea for Canvas come from and how did it get started?

Essentially, the idea behind Canvas was fuelled by parents who were trying to provide a cashless solution for their children’s pocket money and daily expenses and a convenient trackable way of covering daily household expenses for employers of helpers. Especially in today’s digitised life, going cashless is more essential now than ever. As there were no existing products in the market for these two consumer groups— both kids and domestic workers, Canvas was born. Now parents have a cashless solution that is both safe and hygienic, built for today’s digital age.

3. What are the benefits of using Canvas and why is Canvas useful for Singapore families?

4. When would my child use the card and how would using Canvas benefit my child and parents like myself?

Image Credit : Canvas

Image Credit : Canvas6. How does Canvas differ from the usual credit and debit cards available in the market?

Canvas is a prepaid Visa debit card – It can be used widely online and in stores wherever Visa is accepted – tap and go. The Canvas account is created by the parent/employer – they then add cardholders – for their kids and helper. Canvas is designed only for kids and helpers to cover daily expenses, household costs and pocket money. Each child and helper get their own card with their own name on. Parents can topup/transfer and track spend via the app.

7. What are the fees for using Canvas?

9. Lastly, what would you like to say to our readers who are looking forward to sign up for Canvas?

All the above images credit to Canvas

All the above images credit to Canvas